Appraisal 101

What is an Appraisal?

An appraisal is a supported opinion of value. An appraiser performing an appraisal under the Uniform Standards of Appraisal Practice (“USPAP”) provides an opinion of value that is independent, objective, and impartial and performed in line with the Appraisal Process.

What is USPAP?

The Uniform Standards of Professional Appraisal Practice (USPAP) are the generally accepted standards for professional appraisal practice in North America. USPAP contains standards for all types of appraisal services. Standards are included for real estate, personal property, business and mass appraisal.

What is FIRREA?

The Financial Institutions Reform, Recovery and Enforcement Act of 1989 recognizes USPAP as the generally accepted appraisal standards and requires USPAP compliance for appraisers in federally related transactions. State Appraiser Certification and Licensing Boards; federal, state, and local agencies, appraisal services; and appraisal trade associations require compliance with USPAP.

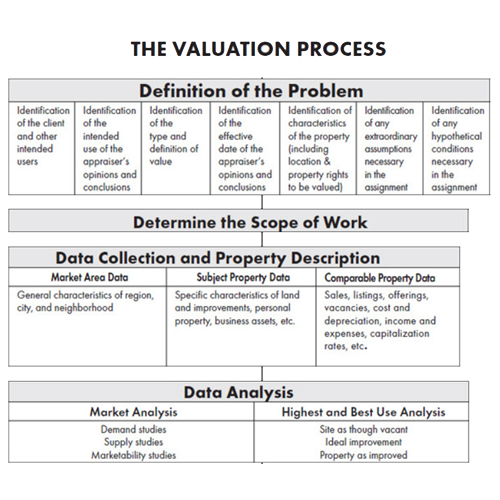

What is the Appraisal Process?

The Appraisal Process, also known as the Valuation Process, is a systematic procedure used in the valuation of real property.

What is Scope of Work?

Scope of Work is defined under USPAP as follows: the type and extent of research and analyses in an appraisal or appraisal review assignment.

What is Highest and Best Use?

Highest and Best Use (HBU), according to the Dictionary of Real Estate Appraisal (Appraisal Institute), is defined as:

The reasonably probable and legal use of vacant land or an improved property that is physically possible, appropriately supported, financially feasible, and that results in the highest value. The four criteria the highest and best use must meet are legal permissibility, physical possibility, financial feasibility, and maximum productivity. Alternatively, the probable use of the land or improved property – specific with respect to the user and timing of the user – that is adequately supported and results in the highest present value.

Typically, the highest and best use of the site as if vacant and the highest and best use of the total property are considered. There is not necessarily a single highest and best use in every circumstance.

The Three Approaches. Appraisers rely on three approaches to develop value opinions for real property. One or more approaches may be relevant in an assignment and which approaches to utilized is a scope of work decision that an appraiser makes based on his or her judgment, what approach(es) appraiser’s peers would decide would be relevant in a similar assignment and the expectations of regular intended users.

Cost Approach.

The cost approach is a summation approach. The approach develops separate values of the vacant site, site improvements, and the improvements. The value of the improvements developed by arriving at an opinion of cost new and then deducting accrued depreciation, which is the loss in value from physical, functional, and external factors.

For many existing properties, the cost approach is not considered applicable since typical market participants do not rely upon the approach in arriving at value indications for properties of this age. The cost approach is typically most applicable for new or nearly new properties.

The steps in the cost approach are summarized as follows:

Cost New

– Depreciation

+ Land Value

= Value

Sales Comparison Approach.

The sales comparison approach is based primarily on the principle of substitution. This principle holds that a buyer would pay no more for a specific property than the cost of obtaining an equally desirable substitute. The principles of supply and demand, balance, substitution, and externalities also apply.

The following outlines the steps in the sales comparison approach.

The competitive market is researched. Possible comparable sales, contracts for sale and current offerings are investigated. The comparable sales selected represent reasonable alternatives for buyers within the subject’s market area.

• From a data set of sales, listing, offers, and other market data, the most pertinent data is further analyzed and verified.

• The appropriate unit of comparison for the subject is determined and applied to the comparable data.

• Each comparable sale is analyzed and, when necessary to account for meaningful differences, adjusted to be equivalent to the subject property. Since comparable properties are not exact substitutes for the subject, analysis must be undertaken to account for differences between the subject and the comparables. Not all sales or listings are comparables.

• The value indications of the comparable data are considered, reviewed, and reconciled into a value indication via the Sales Comparison Approach.

Income Capitalization Approach.

The Income Capitalization Approach converts the anticipated flow of future benefits (income) to a present value indication through capitalizing a single year’s income and by discounting a series of cash flows.

The approach relies on the principle of anticipation. This principle is based on the premise that an investor would base a purchase decision for a property on the capitalized value of the expected income benefits to be derived from the ownership of the property.

What is a Capitalization Rate?

A capitalization rate is any rate used to convert income into value in the Income Capitalization Approach.

What is Final Reconciliation?

Final reconciliation is the penultimate step in the appraisal process. This process occurs before the final value opinion is developed. Reconciliation involves weighing the strengths and weakness of each approach developed and arriving at a final value conclusion for the subject.